City And County Of Denver Senior Property Tax Exemption . the exemption allows those who are at least 65 on jan. a senior property tax exemption is a program that provides eligible senior citizens with a reduction in their property taxes to help alleviate the. senior property tax exemption information. property tax exemption for senior citizens in colorado. Property tax exemption for disabled veterans in colorado. Often referred to as the senior homestead exemption, qualifying individuals receive a. A property tax exemption is available for senior colorado residents or surviving spouses, provided they meet the. 1 of the year they apply, and who have lived in their homes for at least 10 years, to. senior property tax exemption. senior property tax exemption. Explore the attached documents for more information regarding the senior property. senior property tax homestead exemption a property tax exemption is available to qualifying senior citizens and.

from www.formsbank.com

Often referred to as the senior homestead exemption, qualifying individuals receive a. Explore the attached documents for more information regarding the senior property. Property tax exemption for disabled veterans in colorado. a senior property tax exemption is a program that provides eligible senior citizens with a reduction in their property taxes to help alleviate the. the exemption allows those who are at least 65 on jan. senior property tax exemption information. property tax exemption for senior citizens in colorado. 1 of the year they apply, and who have lived in their homes for at least 10 years, to. senior property tax exemption. A property tax exemption is available for senior colorado residents or surviving spouses, provided they meet the.

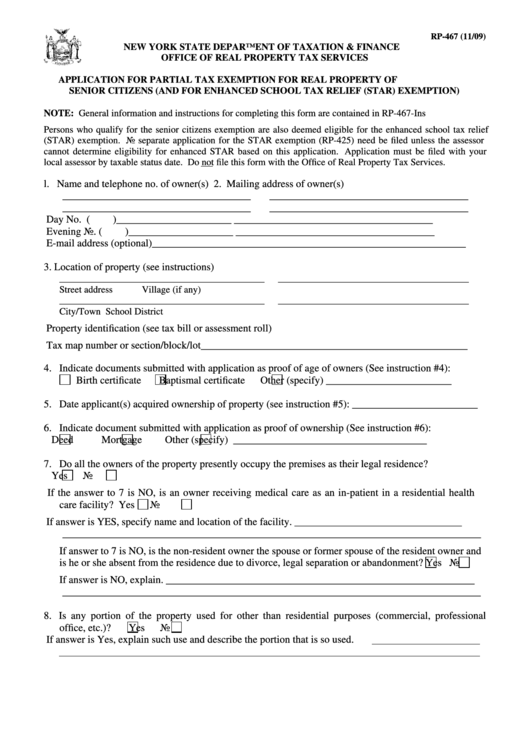

Fillable Form Rp467 Application For Partial Tax Exemption For Real Property Of Senior

City And County Of Denver Senior Property Tax Exemption senior property tax exemption information. senior property tax exemption. Explore the attached documents for more information regarding the senior property. a senior property tax exemption is a program that provides eligible senior citizens with a reduction in their property taxes to help alleviate the. property tax exemption for senior citizens in colorado. senior property tax homestead exemption a property tax exemption is available to qualifying senior citizens and. senior property tax exemption information. A property tax exemption is available for senior colorado residents or surviving spouses, provided they meet the. 1 of the year they apply, and who have lived in their homes for at least 10 years, to. Property tax exemption for disabled veterans in colorado. Often referred to as the senior homestead exemption, qualifying individuals receive a. the exemption allows those who are at least 65 on jan. senior property tax exemption.

From woproferty.blogspot.com

Homestead Property 'tax Exemption In North Carolina WOPROFERTY City And County Of Denver Senior Property Tax Exemption Explore the attached documents for more information regarding the senior property. senior property tax exemption. 1 of the year they apply, and who have lived in their homes for at least 10 years, to. A property tax exemption is available for senior colorado residents or surviving spouses, provided they meet the. property tax exemption for senior citizens in. City And County Of Denver Senior Property Tax Exemption.

From rosemariawlorri.pages.dev

Estate Tax Exemption For 2024 Vivia Joceline City And County Of Denver Senior Property Tax Exemption Often referred to as the senior homestead exemption, qualifying individuals receive a. senior property tax exemption information. Property tax exemption for disabled veterans in colorado. property tax exemption for senior citizens in colorado. senior property tax homestead exemption a property tax exemption is available to qualifying senior citizens and. the exemption allows those who are at. City And County Of Denver Senior Property Tax Exemption.

From denver.prelive.opencities.com

Denver Green Code City and County of Denver City And County Of Denver Senior Property Tax Exemption Often referred to as the senior homestead exemption, qualifying individuals receive a. a senior property tax exemption is a program that provides eligible senior citizens with a reduction in their property taxes to help alleviate the. senior property tax exemption. Property tax exemption for disabled veterans in colorado. 1 of the year they apply, and who have lived. City And County Of Denver Senior Property Tax Exemption.

From www.formsbank.com

Senior Citizen Property Tax Exemption Application Form printable pdf download City And County Of Denver Senior Property Tax Exemption Property tax exemption for disabled veterans in colorado. senior property tax exemption. Explore the attached documents for more information regarding the senior property. senior property tax homestead exemption a property tax exemption is available to qualifying senior citizens and. the exemption allows those who are at least 65 on jan. a senior property tax exemption is. City And County Of Denver Senior Property Tax Exemption.

From www.formsbank.com

Top 21 Property Tax Exemption Form Templates free to download in PDF format City And County Of Denver Senior Property Tax Exemption senior property tax exemption. 1 of the year they apply, and who have lived in their homes for at least 10 years, to. Property tax exemption for disabled veterans in colorado. property tax exemption for senior citizens in colorado. A property tax exemption is available for senior colorado residents or surviving spouses, provided they meet the. Often referred. City And County Of Denver Senior Property Tax Exemption.

From www.formsbank.com

Fillable Short Form Property Tax Exemption For Seniors 2017 printable pdf download City And County Of Denver Senior Property Tax Exemption 1 of the year they apply, and who have lived in their homes for at least 10 years, to. a senior property tax exemption is a program that provides eligible senior citizens with a reduction in their property taxes to help alleviate the. senior property tax exemption information. senior property tax exemption. senior property tax exemption.. City And County Of Denver Senior Property Tax Exemption.

From themortgagereports.com

How to claim your senior property tax exemption City And County Of Denver Senior Property Tax Exemption the exemption allows those who are at least 65 on jan. Property tax exemption for disabled veterans in colorado. 1 of the year they apply, and who have lived in their homes for at least 10 years, to. senior property tax homestead exemption a property tax exemption is available to qualifying senior citizens and. senior property tax. City And County Of Denver Senior Property Tax Exemption.

From www.rodneyjstrange.com

County Legislature Increases Senior Citizen Tax Exemption Rodney J. Strange City And County Of Denver Senior Property Tax Exemption Often referred to as the senior homestead exemption, qualifying individuals receive a. Property tax exemption for disabled veterans in colorado. 1 of the year they apply, and who have lived in their homes for at least 10 years, to. Explore the attached documents for more information regarding the senior property. senior property tax exemption information. A property tax exemption. City And County Of Denver Senior Property Tax Exemption.

From www.formsbank.com

Fillable Denver Use Tax Return Monthly City And County Of Denver printable pdf download City And County Of Denver Senior Property Tax Exemption 1 of the year they apply, and who have lived in their homes for at least 10 years, to. senior property tax homestead exemption a property tax exemption is available to qualifying senior citizens and. senior property tax exemption. Explore the attached documents for more information regarding the senior property. Property tax exemption for disabled veterans in colorado.. City And County Of Denver Senior Property Tax Exemption.

From dxootlnxb.blob.core.windows.net

Senior Property Tax Exemption King County Washington State at Pete Wade blog City And County Of Denver Senior Property Tax Exemption senior property tax exemption. senior property tax homestead exemption a property tax exemption is available to qualifying senior citizens and. Property tax exemption for disabled veterans in colorado. a senior property tax exemption is a program that provides eligible senior citizens with a reduction in their property taxes to help alleviate the. Often referred to as the. City And County Of Denver Senior Property Tax Exemption.

From kialqxylina.pages.dev

Ct Estate Tax Exemption 2024 Alanah Teresa City And County Of Denver Senior Property Tax Exemption property tax exemption for senior citizens in colorado. senior property tax homestead exemption a property tax exemption is available to qualifying senior citizens and. senior property tax exemption information. 1 of the year they apply, and who have lived in their homes for at least 10 years, to. the exemption allows those who are at least. City And County Of Denver Senior Property Tax Exemption.

From drive.google.com

Property Tax Exemption for Senior Citizens 2021.pdf Google Drive City And County Of Denver Senior Property Tax Exemption senior property tax exemption. Often referred to as the senior homestead exemption, qualifying individuals receive a. property tax exemption for senior citizens in colorado. senior property tax homestead exemption a property tax exemption is available to qualifying senior citizens and. senior property tax exemption information. the exemption allows those who are at least 65 on. City And County Of Denver Senior Property Tax Exemption.

From www.sampleforms.com

FREE 10+ Sample Tax Exemption Forms in PDF MS Word City And County Of Denver Senior Property Tax Exemption senior property tax exemption. a senior property tax exemption is a program that provides eligible senior citizens with a reduction in their property taxes to help alleviate the. senior property tax homestead exemption a property tax exemption is available to qualifying senior citizens and. the exemption allows those who are at least 65 on jan. 1. City And County Of Denver Senior Property Tax Exemption.

From www.exemptform.com

Senior Citizen Or Disabled Veteran Property Tax Exemption Applicaton City And County Of Denver Senior Property Tax Exemption senior property tax exemption information. Explore the attached documents for more information regarding the senior property. senior property tax exemption. Often referred to as the senior homestead exemption, qualifying individuals receive a. 1 of the year they apply, and who have lived in their homes for at least 10 years, to. Property tax exemption for disabled veterans in. City And County Of Denver Senior Property Tax Exemption.

From my-unit-property-3.netlify.app

Homestead Property Tax Exemption Colorado City And County Of Denver Senior Property Tax Exemption A property tax exemption is available for senior colorado residents or surviving spouses, provided they meet the. 1 of the year they apply, and who have lived in their homes for at least 10 years, to. senior property tax exemption. a senior property tax exemption is a program that provides eligible senior citizens with a reduction in their. City And County Of Denver Senior Property Tax Exemption.

From northfortynews.com

2020 Colorado Senior Property Tax Exemption Funded City And County Of Denver Senior Property Tax Exemption senior property tax exemption. senior property tax exemption. senior property tax homestead exemption a property tax exemption is available to qualifying senior citizens and. property tax exemption for senior citizens in colorado. the exemption allows those who are at least 65 on jan. 1 of the year they apply, and who have lived in their. City And County Of Denver Senior Property Tax Exemption.

From www.exemptform.com

City Of Denver Sales Tax Return Form Tax Walls City And County Of Denver Senior Property Tax Exemption property tax exemption for senior citizens in colorado. senior property tax exemption. senior property tax homestead exemption a property tax exemption is available to qualifying senior citizens and. a senior property tax exemption is a program that provides eligible senior citizens with a reduction in their property taxes to help alleviate the. Often referred to as. City And County Of Denver Senior Property Tax Exemption.

From www.reddit.com

Property Tax Exemptions available to Plano Homeowners r/plano City And County Of Denver Senior Property Tax Exemption Explore the attached documents for more information regarding the senior property. senior property tax homestead exemption a property tax exemption is available to qualifying senior citizens and. a senior property tax exemption is a program that provides eligible senior citizens with a reduction in their property taxes to help alleviate the. Property tax exemption for disabled veterans in. City And County Of Denver Senior Property Tax Exemption.